January 24, 2025

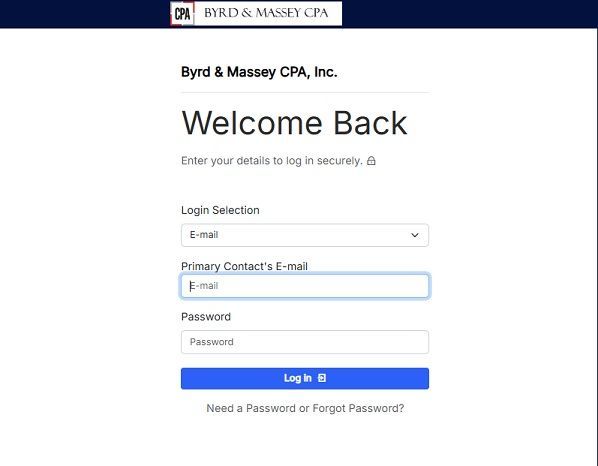

There are two types of educational credits to help students in their continuous pursuit of knowledge: The American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Understanding both is important if you attend college or have kids who do because it can greatly help with your tax bill. American Opportunity Tax Credit (AOTC) This undergraduate tax credit is a partially refundable credit that is good for the first four years in college and assists with students’ expenses such as qualified tuition expenses, school fees, and course materials. You can claim up to $2500 PER student each year; however, your modified adjusted gross income is a factor when claiming this credit. See the numbers below: Based on Modified Adjusted Gross Income (To claim FULL credit) Individual - $80,000 or less Married Filing Jointly - $160,000 Based on Modified Adjusted Gross Income (To claim REDUCED credit) Individual - Less than $90,000 Married Filing Jointly - Less than $180,000 To claim the AOTC credit, you will need the following: A TIN or Social Security Number A 1098-T (or tuition statement) from an eligible educational institution* Be pursuing a degree or other recognized education credential Be enrolled at least half time for at least one academic period beginning in the tax year Not have claimed the AOTC or the former Hope credit for more than four tax years Not have a felony drug conviction at the end of the tax year *Note: If you were not issued a 1098-T, you may still be able to claim the credit by showing proof of payment to the eligible educational institution attended. Lifetime Learning Credit (LLC) This tax credit is for undergraduate, graduate, and professional studies which includes any courses you take to improve job skills. The LLC is exactly that, for a lifetime. The credit never runs out if you are enrolled and taking courses from an eligible educational institution. You, your spouse, or dependent can receive a $2,000 tax credit every tax year. Based on Modified Adjusted Gross Income (To claim $2000 tax credit) Individual - Less than $90,000 Married Filing Jointly - Less than $180,000 To claim the LLC, you need: A 1098-T (or tuition statement) from an eligible educational institution Cannot also claim the AOTC If you do not receive a 1098-T, provide receipts of tuition and other approved expenses, such as course materials. Student Loans If you are one of millions of taxpayers with student loans, then you are already familiar with form 1098-E. Be sure to keep an eye out for yours. Student loan servicers will be sending notifications out this month. Hoping for help with the burden of student loans? There’s an interest deduction for that! According to the IRS, you may deduct the “lesser of $2500 that you paid throughout the previous year OR the amount of interest you actually paid during the year.” The amount phases out when you reach the annual limit for your filing status. For more information on educational and student loan credits click here and if you would like to see the format of the tax form for each credit, visit this link here . As always, we are here to help navigate the ins and outs of tax season. Send your questions to us via your client portal by clicking here to log in. We are happy to help and remember, we’re easy to talk to!