RMDs: An Overview

Birth Year Acknowledgement

If you were born in 1950 or earlier, you should have already started taking your Required Minimum Distributions (RMDs). For those born between 1951 and 1959, you have a bit more time. You can wait until April 1st of the year after you turn 73 to begin taking your RMDs. Those born in 1960 or later will have until April 1st of the year after turning 75. It's crucial to stay informed and compliant with these regulations to avoid any unnecessary penalties. If you have any questions or need assistance, consult with your financial advisor to ensure you're on the right track.

Subsequent RMDs

After taking your first RMD, all future RMDs must be taken by December 31st of each year. If you delay your first RMD until April 1st of the following year, you will need to take TWO distributions in that year, one by April 1st and the other by December 31st. This can have significant tax implications. To ensure you make the best financial decisions, we strongly recommend discussing your RMD strategy with a financial advisor. Stay informed and plan ahead!

First RMD Deadline for IRAs

If you turned 73 in 2024, a first RMD must be taken by April 1, 2025. This applies to ALL types of IRAs, including SEP and SIMPLE IRAs; however, Roth IRAs are an exception. Roth IRA owners are not required to take RMDs during their lifetime.

First RMD Deadline for 401(k) and Other Defined Contribution Plans

If you are still working and do not own more than 5% of the company sponsoring your retirement plan, you may be able to delay your first RMD until after retirement. This exception applies exclusively to workplace retirement plans and does not extend to IRAs, SEP IRAs, or SIMPLE IRAs.

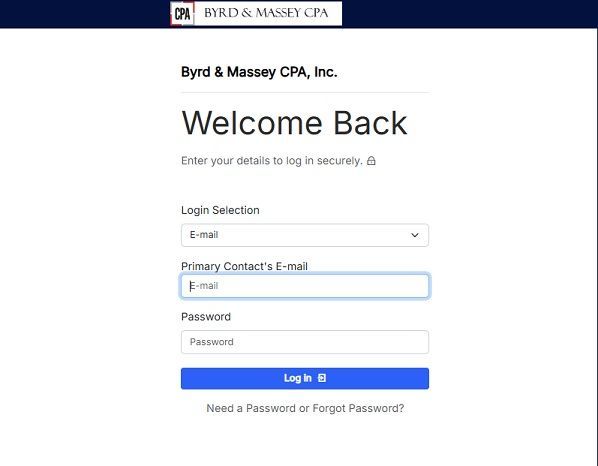

To discuss tax planning strategies, you can book an advisory appointment online or by giving us a call at 479-876-5599. We are happy to help!