Oh, BOI! The Beneficial Ownership Information Report and Financial Crimes Enforcement Network: A Quick Guide

The Corporate Transparency Act (CTA) went into effect on January 1, 2024. As a result, non-exempt companies (almost all closely held businesses, including LLCs, corporations, and limited partnerships) that are registered to do business within any state in the US (reporting companies) are required to file initial and updated reports (BOI Report) to the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) about their beneficial owners and company applicant.

A “beneficial owner” is an individual who either controls 25% of the ownership interests, or directly or indirectly exercises substantial control over the reporting company. Non-owners (such as managers, officers, directors, etc.) can also be beneficial owners for purposes of the CTA.

A “company applicant” is a person responsible for the reporting company’s initial formation or registration. There are 23 types of entities that are exempt from filing BOI reports; however, most entities will not be exempt.

For reporting companies formed prior to January 1, 2024, the initial BOI reports are due by January 1, 2025. For reporting companies formed on or after January 1, 2024, and before January 1, 2025, the initial BOI reports are due within 90 days of formation. For reporting companies formed on or after January 1, 2025, the initial BOI reports are due within 30 days of formation. An updated BOI report MUST be filed within 30 days for any changes in the information given about the reporting company or its beneficial owners.

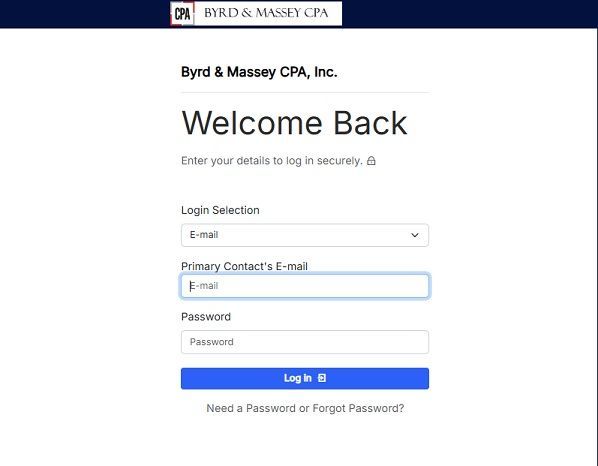

For additional information, here is a link to the website for filing. In general, the following information is required to be included to be in the BOI report:

- Reporting Company

Full legal name

Any trade or doing business as (dba) name

Address for principal place of business in the US

Jurisdiction of formation/registration

Taxpayer identification number (TIN)

- Beneficial Owners & Company Applicants

Full legal name

Date of birth

Unique identifying number (i.e. driver's license or passport)

Current address

Image of the identifying document

Failure to comply with the CTA can result in a civil penalty of $500 per violation per day, and a criminal fine and/or imprisonment of up to 2 years.

Because the consequences of failing to report are significant, we are alerting you so that you may take whatever action is necessary to comply based on your unique circumstances.

PLEASE NOTE: For purposes of clarification, Byrd and Massey will NOT be filing any BOI reports with FinCEN at this time.