Clean Vehicle Credits and You

For the upcoming tax year, you may be wondering if your plug-in electric vehicle (EV) or fuel cell vehicle (FCV) qualifies for any tax credits. The answer is probably. Here is everything you need to know; from new clean vehicles to used and even commercial! Find out who qualifies and how to claim the credit.

New Vehicles

If you purchased and began using a new all-electric, plug-in hybrid, or fuel cell electric vehicle in 2023, you may qualify for up to $7,500 under IRS Section 30D. First, and foremost, the seller MUST have registered and reported the information to the IRS for your vehicle to be eligible. On a positive note, the credit is available to both individuals and their businesses.

Here’s how to know if you qualify:

- You must buy it for your own use and not for resale

- You must use it primarily in the U.S.

- Your modified AGI (adjusted gross income) cannot exceed $300,000 for married couples who file jointly; $225,000 for heads of household; $150,000 for all others

What You Can Expect to Get $:

New requirements went into effect on April 18, 2023, changing the way credits are assessed, splitting them into two categories:

Vehicles placed in service January 1 to April 17, 2023, are credited as follows:

- $2,500 base amount

- + $417 for a vehicle with at least 7 kilowatt hours of battery capacity

- + $417 for EACH kilowatt hour of battery capacity beyond 5 kilowatt hours

- Up to $7,500 TOTAL

Vehicles placed in service April 18, 2023, and after are credited as follows:

- $3,750 if the vehicle meets the criteria minerals requirement ONLY

- $3,750 if the vehicle meets the battery components requirement ONLY

- $7,500 if the vehicle meets BOTH

How Do I Know If My Vehicle Qualifies?

To qualify, your EV or FCV vehicle must meet the standards set forth by the Department of Energy and the EPA and are as follows:

- You must have a battery capacity of at least 7 kilowatt hours

- You must have a gross vehicle weight rating of less than 14,000 pounds

- Your vehicle must be made by a qualified manufacturer

- The vehicle’s MSRP (manufacturer suggested retail price) CANNOT exceed $80,000 for vans, SUVS, and pickup trucks; and $55,000 for other vehicles

Click here to see if your vehicle is eligible for the new clean vehicle credit!

When you are ready to file your tax return, be sure to include the following information so we can help you claim your clean vehicle credit:

- Year, make, and model of vehicle

- VIN (vehicle identification number)

- Date vehicle was placed in service

(Hint: We’re scheduling appointments for 2024 NOW!)

You can read more about the revisions, amendments, and purposes and procedures of the Internal Revenue Code regarding the “new clean vehicle” here.

Oops, I Missed Out!

If you are wondering about a possible credit you missed out on prior to 2022, do not worry! We can usually amend a tax return to reflect the missing information; however, be sure you meet the same guidelines listed above with a couple of differences – you must have a vehicle with a battery capacity of at least 5 kilowatt hours and have an external charging source. You can read, in detail, about qualifications and credits for new electric vehicles purchased in 2022 or before here.

Mine’s Used, What Do I Do?

Guess what? You may qualify! If you purchased your used EV or FCV from a LICENSED dealer for $25,000 or less, you may be eligible for a credit of UP TO $4,000; however, purchases of used clean cars made BEFORE 2023 do not qualify. For more information on previously owned clean cars, click here.

Commercial Clean Vehicles and the Credit

Business and tax-exempt organizations, you have not been left behind! If you purchased a commercial clean vehicle, you too, may qualify for a clean vehicle tax credit of UP TO $40,000 under IRC 45W. Keep in mind a couple of things. According to the IRS, the credit equals the lesser of 15% of your basis in the vehicle (30% if your vehicle is NOT powered by gas or diesel), and the incremental cost of the vehicle. So, the maximum credit is $7,500 for qualified cars with a gross weight rating of under 14,000 pounds and $40,000 for all other vehicles. Click here to see if you meet the specific qualifications in order to receive this credit.

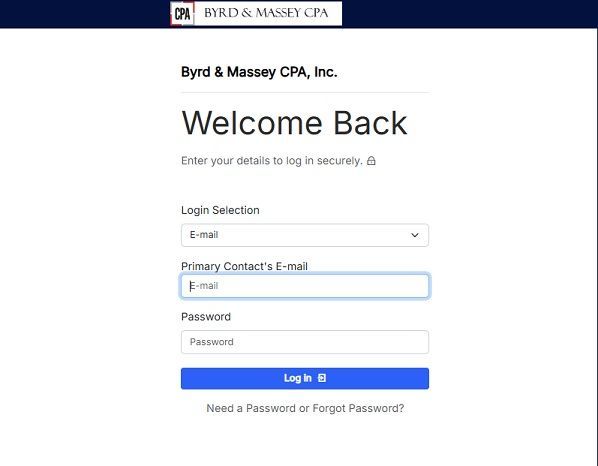

– Byrd and Massey is here for YOU

As always, we are here to guide you through the tax process and give you the best advice and service. If you have any questions about Clean Vehicle Credits, let us know and we will do our best to answer your questions. Our appointment book is now available for the 2024 tax year, so you can book online or give us a call and reserve your spot today! We also have advisory appointments available for those in need of general tax or business advisory services. At Byrd & Massey, we are easy to talk to!